By: Diane Benjamin

White Oak Township met to raise taxes last night. They voted by referendum because the Township needs more money. The Agenda lists the increase “not to exceed” .167%:

The reason given for the tax increase is:

Wind farm revenue is decreasing! The State is also late paying Motor Fuel Tax.

Not surprising, the wind developers declare the wealth that will be flowing to local coffers when they want to build, they forget to say it decreases over time as the turbines age.

If government doesn’t plan for the eventual decline, they have to raise taxes to maintain the roads the wind operator’s trucks are still using.

According to the Warehouse on the Illinois Comptroller’s site, In 2014, 2015, and 2016 the township received $75,000 from wind. http://warehouse.illinoiscomptroller.com/

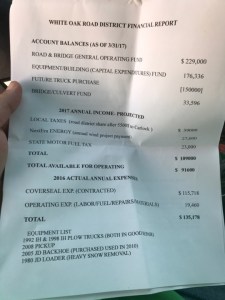

According to a document handed out last night, they will receive $27,000 this year:

Go back to the Warehouse and look at Equalized Assessed Value of the Township.

2014: $30,652,086

2015: $30,158,907

2016: $30,000,039

As the value of land in the township decreases, the tax rate must be increased or tax receipts will decline.

Since the vote was billed as a referendum, and everybody legally eligible to vote did, and the ballot was secret, the residents of White Oak Township will never know how the Board voted.

Only 44 people showed up to vote. 30 of those voted for higher property taxes. If your property is valued at $250,000, it should be assessed at 1/3. That means you are taxed on $83,333. If the Board votes to increase the rate to the maximum approved, multiply that by .167%. That means you will pay $139.17 more a year. That’s in addition to the State Income Tax increase, the State Gas Tax Increase, and all the other tax increases by local governments with big dreams and unwilling to live within their means. (Like normal people do)

Government won again because the people let them win.

Don’t Steal, The Government Hates Competition!

As someone that is for more renewable energy sources, as you probably already know, you must be aware that a declining income in taxes was known when these were approved. Much like the tax subsidy’s on old oil wells because of declining amounts of oil that might be left. Not a “Just Came Up” thing.

Is it just my own computer or did BLN News delete a few comments, and if so, why?

Nothing deleted here!