Jamie Mathy’s house is under his wife’s maiden name – it lost assessed value too:

I hope you realize decreases in assessed value likely mean your house is worth less. When you sell it it will sell for less. If your house was your nest egg, it is being chipped away by bad fiscal policy.

by: Diane Benjamin

Maybe the Council is waking up to falling property values. Six of the 10 had decreases in the Assessed Value of their homes from 2016 to 2017. The question is: Do they realize that $40 million a year in increased City spending and taxing is to blame? Will the property tax rates be increased to compensate for falling values?

Keep in mind, the taxes paid in 2018 were for the value in 2017. Next year they will likely fall again.

David Hales finally sold his house for $31,500 less than he paid for it in 2008.

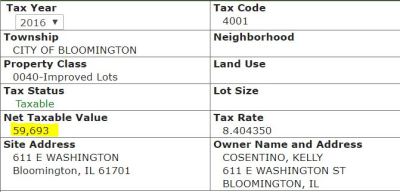

The taxable value of David Sage’s and Diana Hauman’s homes stayed the same. Nothing is on the County website for Jamie Mathy. There is a Scott Black listed as owning a house on the west side. It was purchased in 2017 for more than the previous taxable value. Amelia Buragas owns two homes, the value of the one on E Washington stayed the same.

Below are screen shots showing the taxable value for 2016 and 2017.

The first one is in Karen Schmidt’s husband’s name. They also own numerous rental properties:

I checked a few of Renner’s neighbors, most decreased too.

.

.

.

.

.

.

.

.

.

.

.

I am guessing it is more of taking care of their own, since I am sure a lot of the “normal” people did not see this.

So Tari and Margot own a house together. I knew they were shacking up, but I just thought she was free loading off of him.

My tax rates stayed the same. No decreases for me.

You are not of the royal court as neither am I. We are serfs that like Soaulding in Caddyshack….”You will get nothing and Like it”.

Regardless of if assessments changed or not most of them are for thousands of dollars more than market value. They’re all higher than they should be.

Good thing Hales got his kiss on the way out the door in BOTH Bloomington and Joilet. As for the rest of us, well…not so much. I’m with Cavewoman, ALL property in Bloomington is overvalued/priced to the market now (and especially in the near future). There’s clearly an oversupply for virtually no demand, while the local economic numbers are stagnant at best. And, please don’t parrot back to me/us the establishment line from the local realtors association or EDC. I’m lowering myself down into a lifeboat, I’m not interested in rearranging the deck chairs on the Titanic that is Bloomington.

Understand my comment about us being serfs does not mean I think our assessments are fair, they are not. All one has to do is go to realtor.com and look at homes like their own in another state and see what the selling price is and what the assessment is. I won’t even go into comparing what the tax is. Problem with all this is simply the meathead local government losers will just increase the multipliers if home assessments are lowered. The only way to beat this is force them to cut spending, giving away TIF’s and trying to polish a turd (downtown Bloomington and Normal) with our tax money as the cloth. Maybe the time has come to show some interest using the same tactics as the “Welcoming City” protestors. I will bet that a lot more people wanting a change in this community concerning the #1 highest real estate taxes in the US, than people who wanted a change in the “Welcoming City crap! .

This is just the beginning for this area. The saying is “you ain’t seen nothing yet” applies here. Ask anyone trying to sell the McMansions in the area? Buyers are almost non-existent for high end homes. Now what happens when State Farm goes through another contraction? This is going to happen… most likely after the 1st of the year. Will there be more layoffs and more high paid positions being replaced by $15 an hour wage slaves? Of course, State Farm is in trouble and they are doing nothing to make things better. The saturation of homes for sale will do nothing but get worse and home values will continue to decline.

100% Correct. First the jobs are going away, The other hope does not exist, people do not look at Illinois as a retirement option. A lot of people will be losing big money. Those left behind won’t be able to consider getting a “good deal” as they can’t even begin to consider the real estate taxes.

ALL this really comes as NO surprise, as it is a “general tendency” of people who are BAD at managing a business, facility, city, etc, are ALSO going to be BAD at running their OWN affairs. So the former MAnager, and mayor and council will continue to click heir heels and wander off to OZ! As ignorance is bliss and “You can’t fix stupid”..

As for State Farm. I DO NOT blame them. They are in the PRIVATE sector and NEED to show profit to remain viable, so they make tough decisions to “manage” their losses or maintain the profit margin, whereas the city illuminati choose to just carry on spending full ahead!

While JB definitely got preferential treatment when he got away with removing his toilets, these decreases are likely just the result of the neighborhood multiplier. This compares recent sales to taxable value and creates a multiplier that is applied to each house in the neighborhood. It doesn’t look at your house individually at all.

The assessor realizes values are decreasing, especially if they are challenged. It isn’t a good sign.

Everyone in BN should absolutely challenge their assessed value. We sold our house two months ago for 80% of the price it sold for in 2007 and for 89% of the price it sold for in 2012. The house is in a neighborhood that our realtor said has been historical recession proof since it’s a high demand area.